Auto Insurance in and around Northville

Auto owners of Northville, State Farm has you covered

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

Be Ready For The Unexpected

Choosing your auto insurance provider doesn't have to be overwhelming. With State Farm, you can be sure to receive reliable coverage. Among the plethora of options out there for deductibles and coverage options, State Farm makes the decision easy.

Auto owners of Northville, State Farm has you covered

Insurance that won't drive you up a wall

Navigate The Road Ahead With State Farm

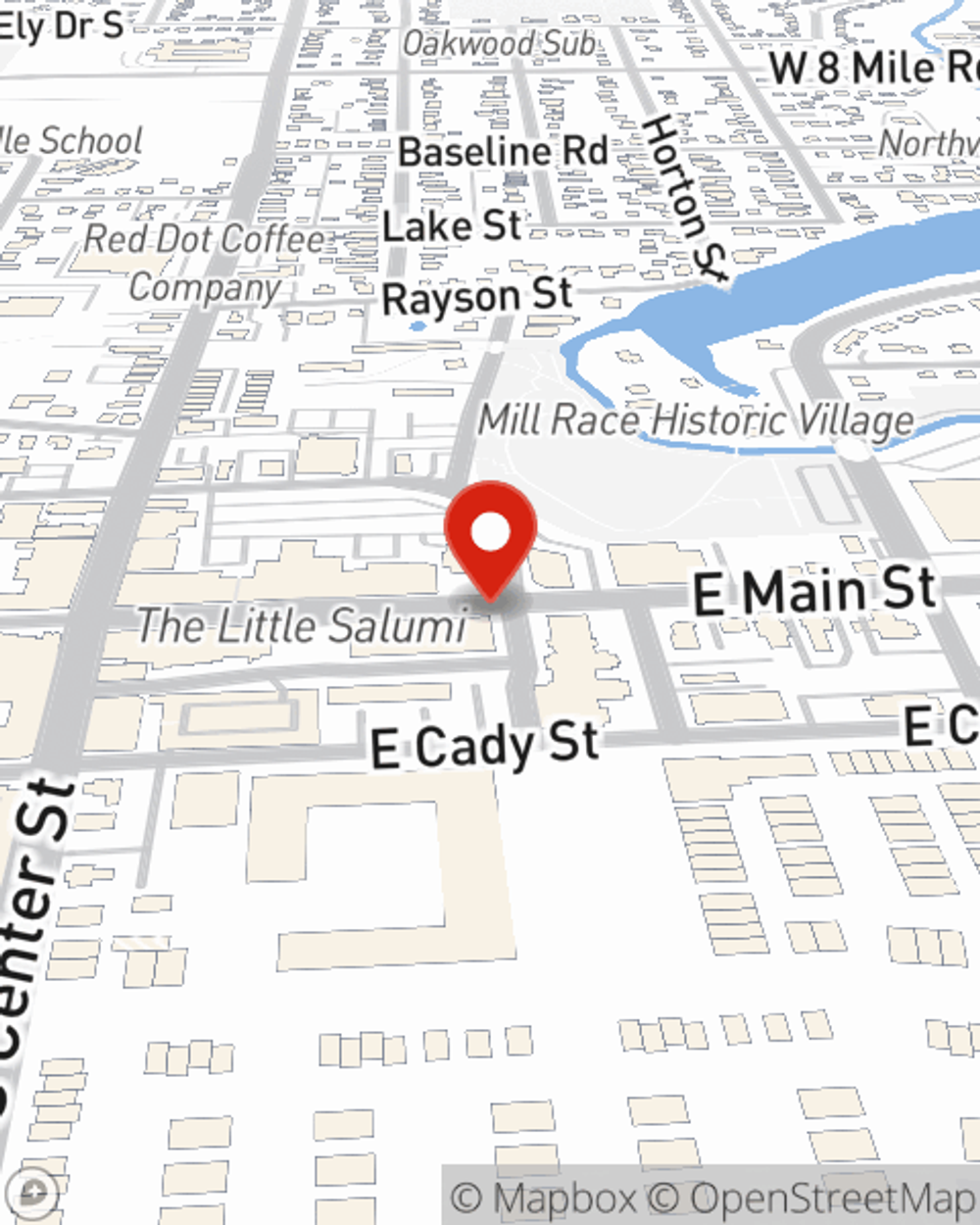

With State Farm, you won’t have to sort it out alone. Your State Farm Agent Nancy DeMars can help you understand your coverage options. You'll get the excellent auto insurance coverage you need.

This can include coverage for a variety of situations and vehicles, too, like sports cars, electric and hybrid cars or antique or classic cars. And the benefits of State Farm don't stop there! When hazards get in your way, you can be sure to receive personalized attentive care from State Farm agent Nancy DeMars. Reach out to Nancy DeMars's office today!

Have More Questions About Auto Insurance?

Call Nancy at (248) 924-3236 or visit our FAQ page.

Simple Insights®

How to use vehicle safety ratings to help you purchase a car

How to use vehicle safety ratings to help you purchase a car

Crash test ratings and other vehicle information can help you make an informed new or used vehicle purchase.

What is uninsured and underinsured motorist coverage?

What is uninsured and underinsured motorist coverage?

Learn why Uninsured (UM) and Underinsured (UIM) Motorist coverage is important car insurance protection if you're in a crash with someone who can't pay.

Nancy DeMars

State Farm® Insurance AgentSimple Insights®

How to use vehicle safety ratings to help you purchase a car

How to use vehicle safety ratings to help you purchase a car

Crash test ratings and other vehicle information can help you make an informed new or used vehicle purchase.

What is uninsured and underinsured motorist coverage?

What is uninsured and underinsured motorist coverage?

Learn why Uninsured (UM) and Underinsured (UIM) Motorist coverage is important car insurance protection if you're in a crash with someone who can't pay.